When considering investing in real estate, determining the potential return on investment (ROI) is a must. ROI helps you assess whether your investment will be profitable in the long run.

And at Black Brook Capital, we’re here to help finance your real estate endeavors.

Understanding ROI in Real Estate

To make informed decisions about investment properties, it’s important to understand the concept of return on investment (ROI). ROI helps you determine how profitable an investment property is likely to be.

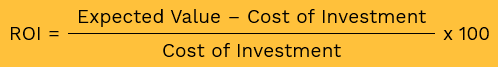

How is ROI calculated?

First, subtract your total expenses (such as purchase price, repairs, and closing costs) from the expected profit (rental income, property appreciation, and tax benefits). Then, divide that result by your total expenses and multiply it by 100 to get the ROI percentage.

Let’s say you purchase a home for $140,000, estimate spending $10,000 in repairs, and expect to be able to sell it for $180,000. Your total cost—the purchase price plus estimated repairs—is $150,000. Following the formula:

- Subtract $150,000 from your expected value ($180,000) to get $30,000.

- Divide that by $150,000 to get .2.

- Then multiply by 100 to get 20, which is 20% ROI.

A 20% return shows it’s a pretty solid investment.

Factors Affecting ROI

Several factors can impact the ROI of an investment property. Rental income, property expenses, property value appreciation, financing costs, and market conditions all play a role in determining the potential profitability. Analyzing these factors helps you estimate the ROI more accurately.

Assessing Income Potential

Determining the income potential of an investment property is an important step in understanding how much money you can make from it.

- Rental Income: Rental income is the money you receive from tenants who rent your property. Consider factors such as the rental rates in the area, the property’s size and features, and the demand for rental properties.Researching local rental market trends and comparing similar properties can give you an idea of how much rent you can charge.

- Market Demand: Factors such as population growth, job opportunities, and the overall economic condition of the area can affect the demand for rentals.Strong demand indicates a higher likelihood of attracting tenants and generating consistent income.

- Property appreciation: Several factors influence property appreciation. These may include:

- Location of the property.

- Economic growth in the area.

- Infrastructure development.

- Overall market conditions.

But market conditions can change, and property values can fluctuate. You should not rely solely on appreciation as a source of profit for your investment. A comprehensive approach considers other factors such as rental income and expenses.

Evaluating Expenses

When considering an investment property, it’s essential to understand the expenses involved in owning and maintaining it.

- Repairs and Maintenance: Properties require regular upkeep, and repairs may be necessary from time to time. It’s important to budget for repairs such as fixing leaky faucets, replacing worn-out appliances, or addressing any structural issues.

- Property Taxes: Property taxes are fees imposed by local governments based on the value of the property. Research the property tax rates in the area to understand how much you’ll need to pay annually.

- Insurance: Insurance is crucial to protect your investment property from potential risks and liabilities. It typically covers damages, liability claims, and loss of rental income.

- Utilities: If you don’t include these in tenants’ rent.

- Vacancy Costs: There may be periods when your property is vacant and not generating rental income. It’s important to account for these potential vacancies in your financial planning.

By evaluating the expenses associated with an investment property, you can understand the financial obligations involved in owning and maintaining it.

Considering Loan Expenses

When evaluating an investment property, it’s important to understand the costs associated with financing the purchase.

When evaluating an investment property, it’s important to understand the costs associated with financing the purchase.

- Down Payment: When buying an investment property, you typically need to make a down payment, which is a percentage of the property’s purchase price that you pay upfront.

- Mortgage Payments: If you finance the property with a mortgage loan, you’ll have monthly mortgage payments to make.

- Interest Rates: Interest rates determine the cost of borrowing money. They can vary depending on market conditions and your creditworthiness. Higher interest rates can increase your borrowing costs and impact your overall profitability.

- Loan Terms: Loan terms refer to the length of time you have to repay the loan. Conventional mortgage loan terms are 15 or 30 years. Longer loan terms can result in lower monthly payments but may also mean paying more in interest over time.Hard money lenders like Black Brook Capital have shorter loan terms—generally six moths to a year. The monthly payments are higher, but can save you money on interest.

- Closing Costs: Closing costs are fees associated with finalizing the purchase of the property and obtaining the loan. These costs can include loan origination fees, appraisal fees, title insurance, and attorney fees.

Understanding Risk and Reducing Potential Problems

When investing in real estate, it’s important to understand the risks involved and how to minimize them.

- Market Risk: Real estate markets can go through ups and downs. Prices may fluctuate, and demand for rentals can change. To mitigate market risk, research the local market trends, economic conditions, and growth potential. Diversify your investments across different locations to spread the risk.

- Cash Flow Risk: Cash flow risk refers to the possibility of not generating enough rental income to cover your expenses. To minimize this risk, ensure you have accurate estimates of rental income and consider potential vacancies or unexpected expenses. Maintaining a financial buffer can help you cover any shortfalls.

- Financing Risk: Financing risk relates to the challenges of obtaining or refinancing a loan. Changes in interest rates, lending regulations, or your financial situation can affect your ability to secure favorable financing terms. Consider working with a knowledgeable lender and be prepared with alternative financing options if needed.

- Property-Specific Risks: Each property comes with its own set of risks, such as maintenance issues, property damage, or tenant-related problems. Conduct thorough inspections, invest in property maintenance, and screen tenants carefully to reduce the likelihood of these risks. Having landlord insurance can also provide protection against unforeseen events.

- Legal and Regulatory Risks: Real estate investments are subject to legal and regulatory requirements. Ensure you comply with local laws, zoning regulations, and landlord-tenant laws. Seek professional advice when needed to understand your obligations and protect yourself from legal risks.

Mitigation Strategies

To minimize risks, consider implementing mitigation strategies such as:

- Building a diverse portfolio of properties to spread the risk across different locations and property types.

- Conducting thorough due diligence before making an investment decision.

- Working with experienced professionals, such as real estate agents, property managers, and attorneys, to navigate potential challenges.

- Having a contingency fund to handle unexpected expenses or vacancies.

- Staying informed about market trends, economic indicators, and local factors that can impact property values and rental demand.

Risk cannot be eliminated entirely, but careful analysis, strategic planning, and proactive risk management can help you reduce potential problems.

Conclusion

Investing in real estate can be a profitable venture, but it requires careful analysis and consideration.

When you’re ready to start investing in residential real estate, contact us at Black Brook Capital. We’re focused on hard money lending in Milwaukee, with years of experience in the local construction industry. We are your perfect partner to turn your vision into reality.

When you’re ready to start investing in residential real estate, contact us at Black Brook Capital. We’re focused on hard money lending in Milwaukee, with years of experience in the local construction industry. We are your perfect partner to turn your vision into reality.