Before hard money lenders will consider you for a loan, you have to find a property. Whether you want to flip or rent (see the BRRRR method), the distressed property itself is the centerpiece of the deal.

But what exactly is a distressed property? And what’s the best way to find one? This article will help answer those questions.

What is a distressed property?

A property becomes distressed when its owner can no longer manage it properly. There are generally three types of distress:

- Financial distress: The owner can’t pay property taxes or make mortgage payments. The property is in foreclosure or already owned by the bank.

- Personal distress: Properties that are sold or in disrepair due to personal matters such as inheriting a house or a divorce settlement.

- Property distress: The owners don’t have the money, time, or motivation to conduct needed repairs.

Types of distressed properties

- Foreclosed Home: When a borrower misses too many payments, the mortgage lender repossesses the property. To make its money back, the lender tries to sell the property at auction.

- REO Properties: Real estate owned (REO) properties are bank-owned properties that don’t sell at auction.

- Short sale: The short sale option saves both the distressed borrower and the lender the red tape of a foreclosure. With a short sale, the seller pays less than the payoff amount while the bank sells the home to make a profit. In exchange, the lender forgives the remaining balance of the seller’s loan.

- Pre-foreclosure: This is the first step of the foreclosure process, when the borrower has missed at least three mortgage payments. Investors can make an offer to the lender to turn the house into a short sale and get the property at a bargain.

- Tax lien sale: When a property owner doesn’t pay income or property taxes, the government can claim the house. Investors who buy tax lien sales may need to pay the tax lien encumbrances before owning the property outright.

Finding a distressed property

Take a drive

There are many popular online resources for finding distressed properties, which will be discussed below. But online listings are viewable from anywhere, and competition for those properties may be stiff.

Driving the streets may be more time consuming than searching online. But the extra effort may yield opportunities other investors will miss. Here are some telltale signs of a distressed property:

- Neglected appearance compared to other homes on the block.

- Yard overgrown with weeds.

- Lights that are not turned on at night

- Broken windows or damaged shutters.

- Faded and peeling paint or deteriorating siding.

- Notices posted on doors or windows.

- Uncollected newspapers and junk mail.

- Boarded up doors and windows.

- Trash on the sidewalk or driveway.

After identifying homes that appear distressed, you can find the names and addresses of the property owners at your local tax assessor’s office. Then you can send them letters to inquire about purchasing the properties. You can also partner with a real estate agent to help locate and contact the owner on your behalf.

Some homeowners will ignore you, but others might be eager to sell to an interested buyer before entering into foreclosure.

Find distressed properties online

Maybe you’re uncomfortable contacting homeowners directly or have been put off by callers or texts inquiring about your own property. Fortunately, there are many online resources available.

Zillow

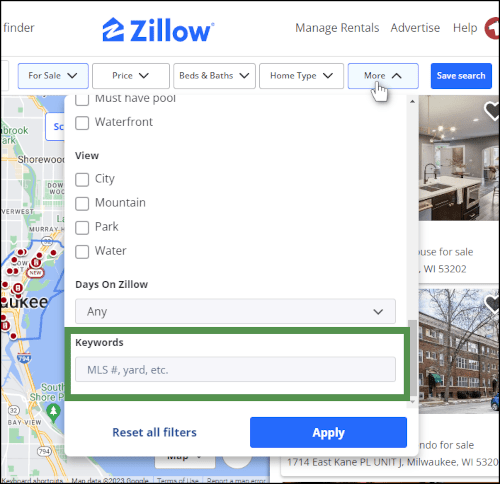

zillow.com screenshot

Zillow’s ease of use and abundant listings have made it extremely popular. Creating an account is easy and using its keyword search can help identify distressed properties.

To find the keyword field, you have to scroll to the bottom of the More dropdown menu (see image). Keywords that may reveal distressed properties include:

- for sale by owner

- must sell

- fixer

- rehab

- as is

- condemned

- handyman

- damage

- cash only

- proof of funds

- negotiable

- foreclosure

- probate

- REO

- divorce

Time-saving tip: During your first session, click the blue Save search button after each keyword search. Then you won’t have to type them again during future sessions.

Craigslist

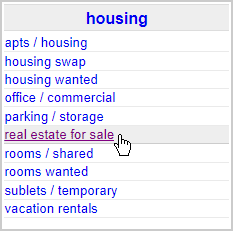

craigslist.com screenshot

You can enter the same keywords on Craigslist. Create a free account and navigate to the “real estate for sale” category under housing.

Distressed property websites

There are several websites devoted solely to listing foreclosures and short sales. Not every site is updated regularly, so start with the most reputable websites for distressed properties:

- HUD Home Store: Provides a comprehensive list of homes that have been acquired by the government. You can browse the homes, but a HUD-registered real estate agent must submit an offer.

- HomePath.com: Gives you the chance to pursue thousands of foreclosures owned by Fannie Mae.

- HomeSteps.com: Provides an inventory of Freddie Mac foreclosures that are available to investors and homebuyers.

- Equator.com: Lists thousands of foreclosures, short sales, and open-market listings.

- Foreclosure.com: Has a massive database of foreclosures, though you’ll have to pay $39.99 per month to access them. That’s not necessarily a bad thing—the paywall could limit competition.

- WHEDA (Wisconsin Housing and Economic Development Authority): Provides links to several listings that include both WHEDA-owned and other foreclosed homes in your area.

Other sites include:

- Wells Fargo REO Properties: requires you to contact the listing agent directly.

- CitiMortgage and Bank of America: properties in foreclosure owned by the banks.

- RealtyTrac: Proprietary information such as pre-foreclosure addresses and owner information for a fee of $49.95/month.

- Government sites for foreclosure listings:

Government records

Most county websites provide searchable databases to find potential properties. For example, see the Milwaukee County Foreclosed Property Sales website. Otherwise, you can visit your local courthouse or clerk and recorder’s office in person.

County tax records

If a homeowner can’t pay their taxes, the property may soon become distressed. Unpaid property taxes are also an indication that the property owner may be delinquent on their mortgage as well.

Court records

The public records section of the county recorder’s office lists notices issued to a homeowner and publicly recorded before and during the foreclosure process, including Notice of Default, Lis Pendens, and Notice of Sale.

Property auctions

screenshot of auction.com

REO property is often sold at auction if a lender forecloses on a home and is unable to sell it directly. Property auctions are advertised in your local paper, and on real estate auction websites such as Auction.com, RealtyBid.com, and Tranzon.com.

Partner with a real estate agent

Partnering with an agent who specializes in distressed properties, pre-foreclosures, and house flips can give you the inside track on investment opportunities. Agents often have intimate, block-by-block knowledge of their neighborhoods and are the first to know when a property is headed for the market.

This can be especially helpful if you don’t live in the area you’re targeting. An agent can also provide access to MLS Listings and other resources.

Get in Touch with the Hard Money Loan Experts

Finding a distressed property is more complicated and time-consuming than investing in a turnkey rental property, but many real estate investors find it worth the extra effort.

If you have found a distressed property that looks like a good investment, contact us at Black Brook Capital. Experienced in hard money lending and veterans in the construction industry, we are your perfect partner to turn your vision into reality.